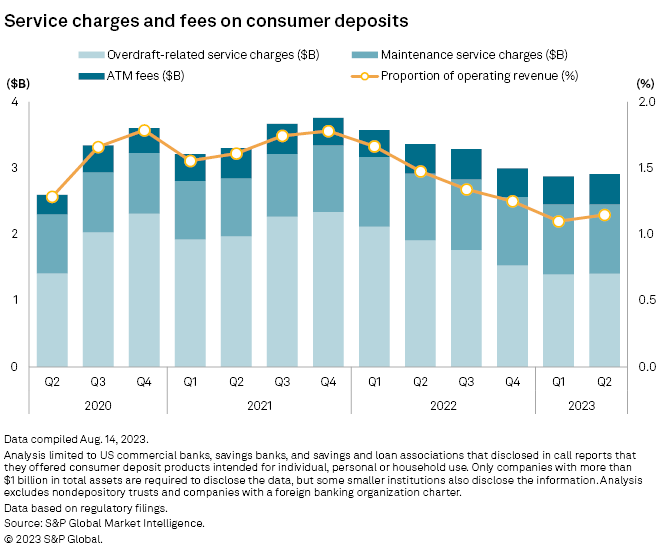

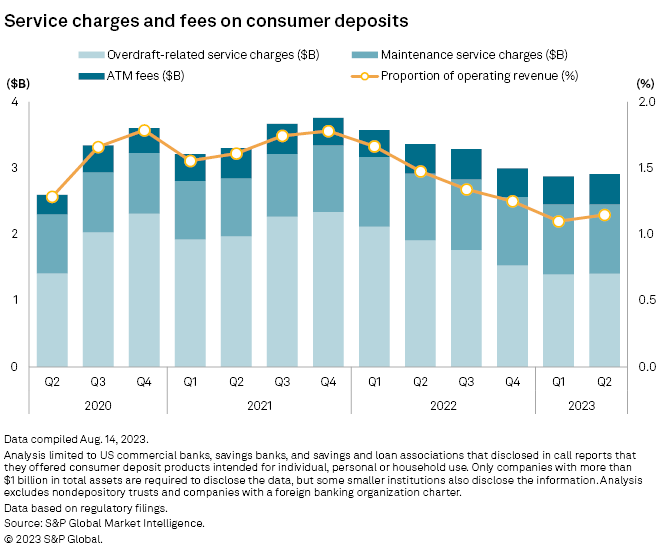

For the first time since the fourth quarter of 2021, US banks recorded a quarter-over-quarter increase in overdraft fee income.

The industry reported $1.41 billion in overdraft fee income in the second quarter, up from $1.40 billion in the first quarter. Previously, US banks' total overdraft fee income had declined for five consecutive quarters after the culmination of regulatory and competitive pressures pushed many banks — namely the largest — to overhaul their overdraft practices.

The overdraft fee increase helped boost the total service charges and fees on consumer deposits, which also rose for the first time since the fourth quarter of 2021. That total moved up to $2.91 billion in the quarter compared to $2.88 billion in the previous quarter.

The quarter-over-quarter rise led to an uptick in service charges and fees on consumer deposits as a proportion of operating revenue, which increased to 1.15% from 1.10% in the first quarter.

Still Historically LowHowever, while the metrics rose for the first time in over a year, they are still down from historical levels. US banks' second-quarter overdraft fee income was down 26.4% from the second quarter of 2022, while total service charges and fees on all consumer deposits were down 13.5% year over year.

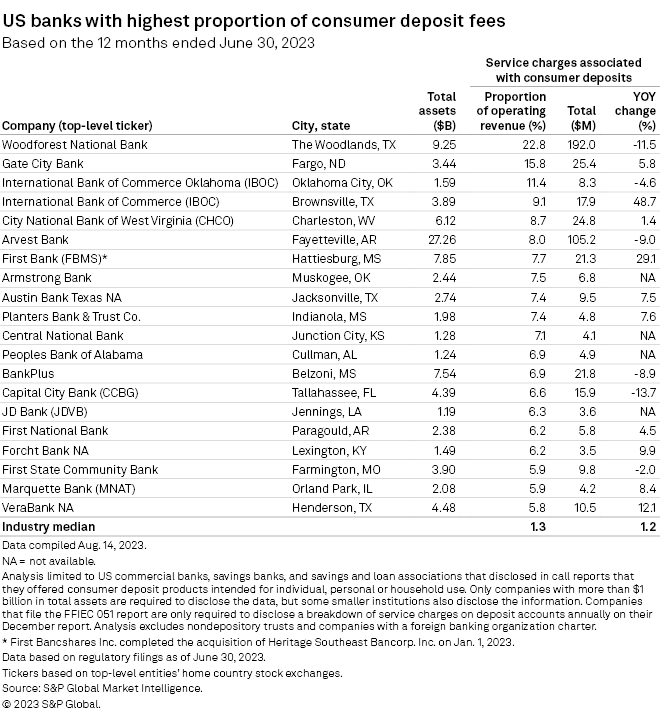

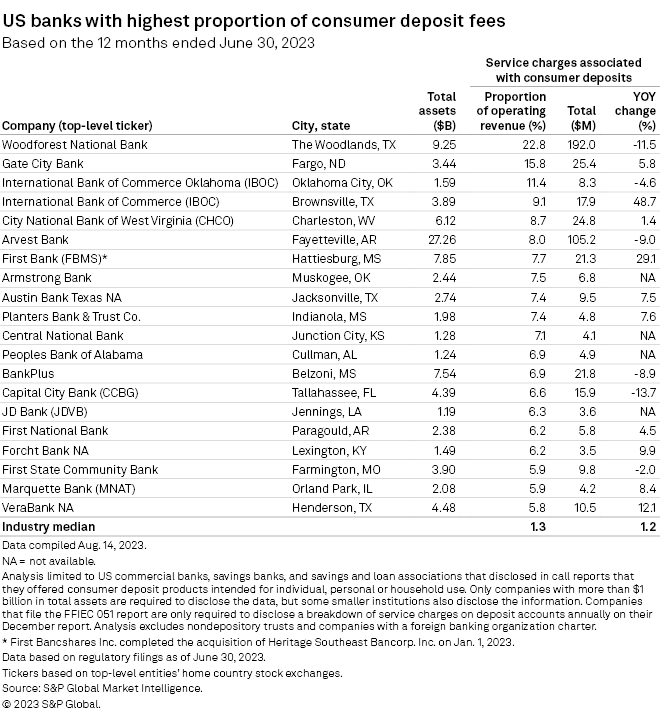

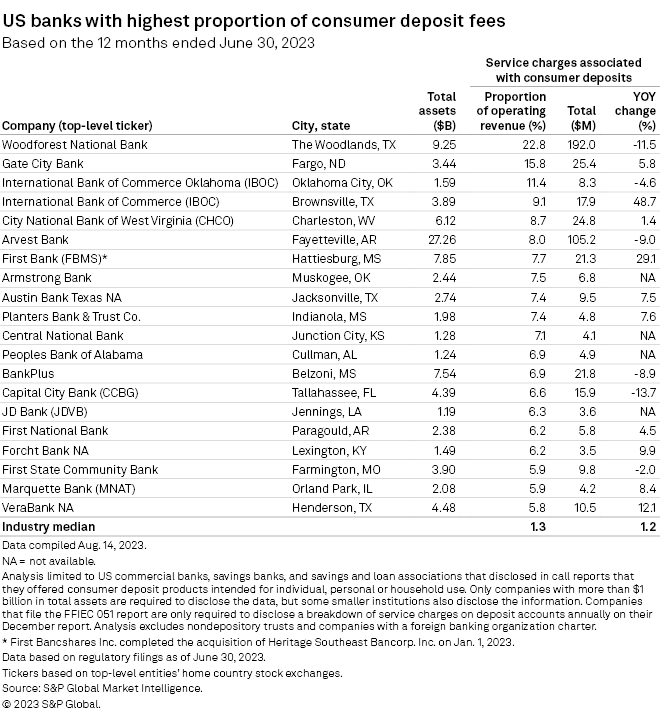

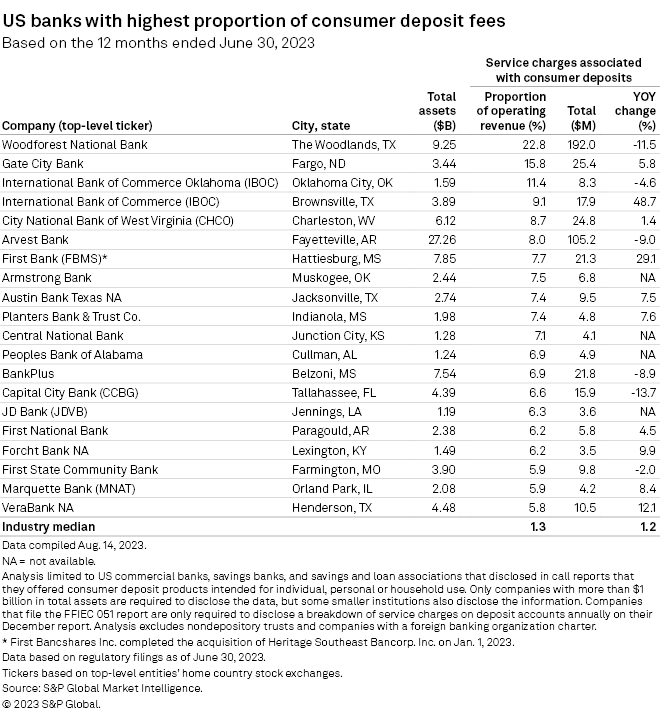

Highest Proporation Of Deposit Fee IncomeSome banks depend on consumer deposit fee income more than others. The service charges on consumer deposit accounts made up more than 10% of three US banks' operating revenue in the first quarter, down from four banks in the linked quarter.

Woodforest National Bank retained its spot atop the list of banks with the highest proportion of consumer deposit fees, though the bank's dependence decreased year over year with an 11.5% decline in service charges associated with consumer deposits.

Most Deposit Fee Income

Woodforest also ranked among the top 20 banks with the most deposit fee income, coming in ninth. It is the only bank on the list with less than $20 billion in assets.

JPMorgan Chase & Co. maintained its spot on the top of that list as its total services charges on consumer deposits rose 2.1% year over year to $2.30 billion. Only three banks among the top 20 by total consumer deposit fee income posted year-over-year increases.

Meanwhile, Wells Fargo & Co. and Bank of America Corp., which rounded out the top three on the list, posted large year-over-year declines in that fee income at 18.6% and 33.3%, respectively.

USAA Federal Savings Bank reported the largest year-over-year decline at 50.2%.

READ ORIGINAL ARTICLE

For the first time since the fourth quarter of 2021, US banks recorded a quarter-over-quarter increase in overdraft fee income.

The industry reported $1.41 billion in overdraft fee income in the second quarter, up from $1.40 billion in the first quarter. Previously, US banks' total overdraft fee income had declined for five consecutive quarters after the culmination of regulatory and competitive pressures pushed many banks — namely the largest — to overhaul their overdraft practices.

The overdraft fee increase helped boost the total service charges and fees on consumer deposits, which also rose for the first time since the fourth quarter of 2021. That total moved up to $2.91 billion in the quarter compared to $2.88 billion in the previous quarter.

The quarter-over-quarter rise led to an uptick in service charges and fees on consumer deposits as a proportion of operating revenue, which increased to 1.15% from 1.10% in the first quarter.

Still Historically LowHowever, while the metrics rose for the first time in over a year, they are still down from historical levels. US banks' second-quarter overdraft fee income was down 26.4% from the second quarter of 2022, while total service charges and fees on all consumer deposits were down 13.5% year over year.

Highest Proporation Of Deposit Fee IncomeSome banks depend on consumer deposit fee income more than others. The service charges on consumer deposit accounts made up more than 10% of three US banks' operating revenue in the first quarter, down from four banks in the linked quarter.

Woodforest National Bank retained its spot atop the list of banks with the highest proportion of consumer deposit fees, though the bank's dependence decreased year over year with an 11.5% decline in service charges associated with consumer deposits.

Most Deposit Fee Income

Woodforest also ranked among the top 20 banks with the most deposit fee income, coming in ninth. It is the only bank on the list with less than $20 billion in assets.

JPMorgan Chase & Co. maintained its spot on the top of that list as its total services charges on consumer deposits rose 2.1% year over year to $2.30 billion. Only three banks among the top 20 by total consumer deposit fee income posted year-over-year increases.

Meanwhile, Wells Fargo & Co. and Bank of America Corp., which rounded out the top three on the list, posted large year-over-year declines in that fee income at 18.6% and 33.3%, respectively.

USAA Federal Savings Bank reported the largest year-over-year decline at 50.2%.

READ ORIGINAL ARTICLE